A pedestrian holds an umbrella while walking in the rain along a street in Times Square in New York on September 26, 2023.

Ed Jones | AFP | Getty Images

While the state of the U.S. economy may be Americans' biggest concern, 2023 was a pretty good year for the macro economy.

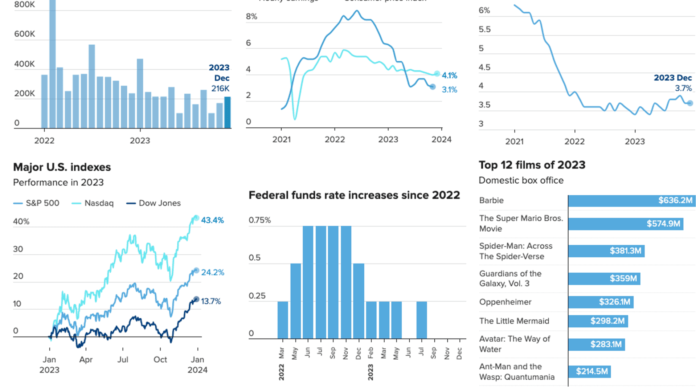

Spending remained high, markets posted big gains and the Federal Reserve's fight against inflation showed signs of slowing — without freezing. Then there is the resilience of the labor market, which defies almost all logic.

The U.S. labor market ended the year strong, adding more than 200,000 jobs in December, according to figures released Friday by the U.S. Bureau of Labor Statistics. While previous job creation estimates for October and November were revised downward by a total of 75,000, the unemployment rate remained at a low 3.7% and December marked the 36th consecutive month of job creation in the U.S. economy .

Overall, the US created almost 2.7 million seasonally adjusted jobs in 2023. That figure came despite concerns that the Federal Reserve's ongoing fight against inflation by raising interest rates could cool the labor market and weaken consumer spending.

However, none of these concerns were realized. In fact, consumer spending remained robust throughout the year, with monthly retail sales remaining above the $600 million mark for most of 2023, proving that US consumers were undeterred despite many economic headwinds.

Here are nine more charts showing how the economy rounded out 2023.

Inflation, wages and spending

While inflation remains top of mind for U.S. consumers, the inflation rate has cooled significantly in 2023. Meanwhile, wages rose throughout the year, eventually outpacing price increases.

US consumers were keen to spend, particularly on experiences: 2023 was officially the year that travel saw a resurgence, with the Thanksgiving holiday breaking US records. Nearly 150 million passengers were screened by the Transportation Security Administration at U.S. airports in November and December.

Americans also spent on entertainment. With big hits like “Barbie,” “Oppenheimer” and Taylor Swift’s concert film “The Eras Tour,” the U.S. box office rebounded significantly last year from its Covid-19 pandemic-related lows.

Markets

Even assets like cryptocurrencies saw a rally in 2023 after hitting bottom in November of the previous year. Bitcoin prices ended the year at almost three times the previous low.

Interest and housing

After its historic rate hikes in 2022, the Federal Reserve has moderated its fight against inflation, raising rates at only four of its eight meetings in 2023. While the central bank's target range for interest rates is the highest since 2006, recent comments from Chair Jerome Powell say Fed watchers are optimistic that rate cuts could come in 2024.

However, there were some problem areas for consumers. Mortgage rates remain high. The average 30-year fixed interest rate in October was nearly three times higher than it was at the end of 2020 — although rates fell significantly through the end of the year — and sales of existing homes remain low, according to data from the National Association of Realtors. Until more housing inventory is available online, these issues will likely persist into 2024.

Don't miss these stories from CNBC PRO: