This section is Presented

This section was created by the editors. The client was not given the opportunity to restrict the content or to check it before publication.

from RBC Mortgages

Breadcrumb Trail Links

The million-dollar price club seems immune to rate hikes

Publication date:

May 13, 2022 • 1 day ago • 4 minutes read • 11 comments  Sales of homes that sold over $1.5 million in Toronto increased 31 percent from 2021. Photo by National Post

Sales of homes that sold over $1.5 million in Toronto increased 31 percent from 2021. Photo by National Post

content of the article

The pandemic real estate boom appears to be over in Canada. Recent sales data from the major housing markets indicate a slowdown in sales compared to last year. Although property prices are still rising, a slowdown in demand is expected to dampen this price increase going forward.

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

Homebuyers and sellers are watching the market with growing concern. When prices fall, buyers worry that they will be left with a depreciating asset. On the other hand, sellers are reluctant to list properties because of concerns that the sale may take longer and they may not fetch the highest dollar. As the motivations of buyers and sellers shift, real estate prices could fall victim.

content of the article

Experts agree that rising mortgage rates have increased the cost of borrowing, which has consequently deterred buyers. With the Bank of Canada expected to hike interest rates further, mortgage costs should move in the same direction. Interestingly, such rapid but expected rate hikes could have different implications for market participants.

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

For example, those who believe that higher interest rates will result in higher mortgage payments may choose to buy now to secure a fixed mortgage rate. At the same time, those expecting house prices to fall might prefer to wait. However, the waiting game could lead them to higher interest payments due to higher mortgage rates.

Consider the following example. A first-time homebuyer with a five percent down payment on a $900,000 home is expected to pay $4,440 a month if the mortgage rate is 3.5 percent. However, when the price has fallen to $800,000 and the mortgage rate has increased to 4.5 percent, the monthly mortgage payment is still about $4,375. Despite the similar monthly mortgage payments, the buyer pays much more interest due to the higher mortgage interest rate.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

Many market observers expected a decline in sales volume for 2022, as the increase in sales from 2021 was not sustainable. Consider that across Canada, Multiple Listing Services (MLS) reported 666,643 sales, up from 552,640 sales in 2020 — a 21 percent increase from the previous year.

A comparison to 2020 may not be appropriate as COVID-19 lockdowns and other restrictions reduced sales volumes that year. However, looking back another year, sales in 2021 were up 35 percent from 2019. Such rapid growth is unsustainable given forward buying in 2021, when homebuyers rushed into the market for fear of missing out and withdrew some sales that would of course have happened in 2022-2021.

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

One mystery remains: Home sales have declined significantly, but home prices have continued to rise, albeit at a slower pace. Sales data from the Greater Toronto Area (GTA) helps explain why sales and prices are not marching in unison.

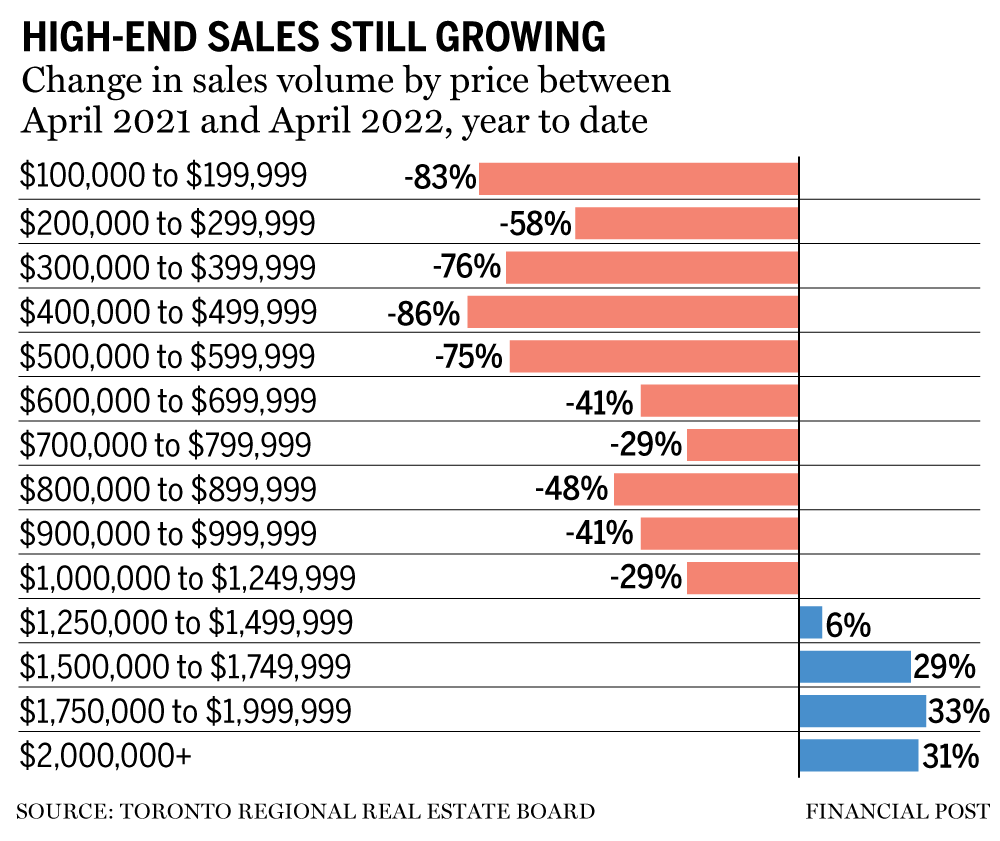

The Toronto Regional Real Estate Board (TRREB) reported 47,157 sales in the first four months of 2021. Year-to-date sales in April 2022 fell to 33,610, down 29 percent. At the same time, the average house price in the GTA increased by 21 percent. The increase in house prices resulted from a decline in sales activity for lower-priced houses and an increase in relatively expensive houses.

Let’s look at the numbers. In 2021, sales of homes that sold for more than $1.5 million from January through April accounted for 15 percent of total sales. A year later, the same price range accounted for 27 percent of sales. Compared to 2021, sales of homes sold over $1.5 million increased 31 percent.

advertising 6

This ad has not yet loaded, but your article continues below.

content of the article

The picture was different for cheaper homes. Year-to-date April 2022 home sales priced between $500,000 and $1 million declined 47 percent compared to the same period last year.

The sales numbers reveal a history of two housing markets: an acceleration in sales of higher-priced homes and a slowdown in sales of low- to mid-priced homes. The dampening effect of mortgage rate hikes is evident at the lower end of the price distribution. On the other hand, the million price club seems to be immune to interest rate hikes.

-

Blind bidding is spreading in the suburbs, but a lack of data is clouding the picture

-

Do you want to make housing affordable? Let downtown homeowners share their lots

-

Destroying the myth of Canada’s millions or more vacant homes

advertising 7

This ad has not yet loaded, but your article continues below.

content of the article

Uncertainty in housing markets is likely to remain for the remainder of the year, both in terms of sales volume and price.

So is now the right time to buy or sell?

We believe that there is no answer to this question. It depends on the individual circumstances. Those who are immune to market volatility can continue to trade. However, extra caution might be the right approach for those whose cash flows are impacted by changes in mortgage rates or prices.

Murtaza Haider is Professor of Real Estate Management and Director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Share this article on your social network

Advertisement

This ad has not yet loaded, but your article continues below.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

Remarks

Postmedia strives to maintain a lively but civilized discussion forum and encourages all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.