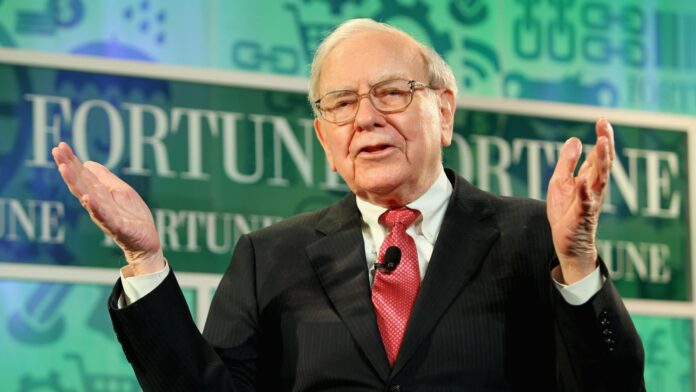

Paul Morigi | Getty Images Entertainment | Getty Images

Warren Buffett said Americans shouldn’t worry about their bank deposits after the recent financial shock in the sector and the government would make sure no depositor in this country loses a penny.

“People shouldn’t worry about losing their money and deposits in an American bank, and today they have no reason to worry,” he said Berkshire Hathaway Chairman and CEO in an interview with Tokyo resident Becky Quick on Wednesday on CNBC’s “Squawk Box.” “But the message has become very confusing and people don’t really understand how it all works.”

The banking sector experienced a brief panic in March as depositors fled Silicon Valley Bank, which had mismanaged its bond portfolio and was overly leveraged into the technology sector. Fear grew that depositors with more than the FDIC’s $250,000 insurance limit would lose their money. But on the weekend of March 12, the government stopped all depositors at the SVB, along with those at Signature Bank, regardless of the amount they held at the banks.

Buffett said the government would likely step in to support all depositors in all US banks if that were ever necessary, although he noted that doing so would require congressional approval.

“We’ll get the OK,” he said when asked if Congress would approve this extraordinary action. Buffett noted that Congress will also adjust the debt ceiling to avoid financial ruin for the country.

The bank closures have sparked a crisis of confidence among investors and customers, who wondered if other financial institutions could face the same fate. Bank stocks fell broadly in March as investors grew more nervous about the sector, with the sell-off focused specifically on regional banks on liquidity concerns. To restore confidence, 11 banks placed $30 billion in deposits Bank of the First Republicwhose shares plummeted during the shock.

Buffett noted that if there are more bank failures, shareholders could lose, and rightly so, but depositors shouldn’t worry.

Buffett’s father

Bank closures are an issue that affects Buffett personally, he said, since his father lost his job and life savings in the 1930s when the bank he worked at went bust.

But things have changed for the better since the Great Depression in terms of regulations and knowledge of bank runs and what such things can do to a financial system. The Federal Deposit Insurance Corporation was formed during the Great Depression.

Buffett, 92, said he was so confident that US depositors were certain he would bank a million dollars of his own money and urged someone else to do the same. He said he would donate that money to charity at the end of the year if just one American lost their deposits to a bank closure, but he’ll keep the other person’s money if US depositors remain intact.

“If an American saver lost money to a bank failure, the other soul can name where the $2 million goes, to which charity,” he said. “If not, I’ll get the payment. And that’s a firm offer and we’ll see who comes forward.”