Breadcrumb trail links

The bankruptcy comes at a turbulent time for the office real estate markets, but experts believe that the overall impact will only be temporary

Published on November 9th, 2023 • 3 minutes reading time

A co-working office space owned by WeWork Inc. in New York, USA Photo by Yuki Iwamura/Bloomberg

A co-working office space owned by WeWork Inc. in New York, USA Photo by Yuki Iwamura/Bloomberg

Article content

The bankruptcy of office-sharing giant WeWork Inc. is casting another shadow over Canada’s struggling commercial real estate market, but industry observers expect the overall impact will be temporary.

WeWork was founded in 2010 and was once worth $417 billion. On November 6, the company announced that the company had begun a comprehensive restructuring process, including a Chapter 11 bankruptcy filing in the United States and plans for recognition proceedings in Canada.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

Article content

The company said in a news release that it has the support of key stakeholders for a restructuring that would “dramatically reduce its existing funded debt” and improve its financial stability.

WeWork CEO David Tolley told the Associated Press in a statement that the new deal is expected to eliminate about $3 billion of the company’s debt. The company’s bankruptcy filings showed it had $18.65 billion in liabilities and $15.06 billion in assets as of June. Lease liabilities, which account for about two-thirds of WeWork’s operating costs, remain the company’s biggest financial obstacle.

The bankruptcy comes at a turbulent time for office real estate markets, which have seen a rise in vacancies in the wake of the pandemic as home offices and hybrid work arrangements have become established.

According to real estate and investment management firm Jones Lang LaSalle Inc., the overall office vacancy rate in downtown Toronto reached 15 per cent in the third quarter of 2023. Before the pandemic, in the third quarter of 2019, this number was two percent.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

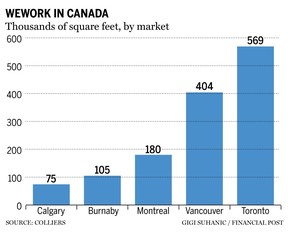

As part of WeWork’s restructuring, the company announced it would exit 69 leases, including two in Toronto, two in Vancouver and one in Burnaby, B.C. Forty of the leases it plans to terminate are in New York. The company said all members affected by the changes were notified prior to the U.S. bankruptcy filing.

WeWork expanded rapidly in Toronto after opening its first location in 2017, according to a report from commercial real estate services and investment firm CBRE. Within two years, the company had a dozen locations covering 62,000 square feet, a sixfold increase.

Then in 2020, following a $1 billion deal with HBC, the company opened its largest branch in Toronto, spanning two floors in the Hudson’s Bay Co. building at Yonge and Queen, across from the Eaton Centre.

Tobin Davis, vice-chairman of sales at Colliers Canada, noted that while lease liabilities pose a significant challenge for WeWork, the vacancies resulting from their exit will represent only a small portion of the Canadian market.

“Coworking spaces account for just 1.1 percent of the nation’s total office space inventory,” Davis said. “The reality is we are only talking about one player, right? There is still (approximately) 6.6 million square feet of co-working space alone. The overall health of co-working spaces remains good.”

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

According to Colliers, WeWork only accounts for about 0.5 percent of Toronto’s total office space.

Davis assumes that most of WeWork’s spaces will remain co-working locations despite the bankruptcy and that landlords will decide on new operators in the future.

“The majority of the space will probably continue to exist as co-working space. (WeWork’s) business model has failed. I think that during times of higher real estate prices they were simply focused on signing large leases in urban markets and it caught up with them.”

similar posts

-

The city center survived the 1980s – and it will also survive the 2020s

-

Hines believes the office needs to be more than just a place to work

-

With commercial real estate loans, the risk is greater than previously assumed

In 2020, the Greater Toronto Area (GTA) had approximately 3.14 million square feet of shared workspace, accounting for 1.8 percent of total office space. In the city center, shared workspaces covered 2.32 million square feet, representing 2.4 percent of the area’s office stock. Nationally, the Canadian shared workspace market was approximately 6.1 million square feet.

A press release on WeWork’s website said that while the company has not yet commenced legal proceedings in Canadian courts, it plans to file recognition proceedings under Part IV of the Companies’ Creditors Arrangement Act.

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask that you keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. For more information and details on adjusting your email settings, see our Community Guidelines.