As natural disasters cause increasing damage across the country, they are also upending the home insurance industry, which passes on the higher costs of maintaining homes to policyholders.

U.S. insurers paid out $99 billion in natural disaster-related claims in 2022, according to a study by Policygenius, an online insurance marketplace. As a result, premiums rose an average of 21 percent from May 2022 to May 2023, dwarfing the 12 percent increase compared to the previous year. The study examined more than 17,000 policies renewed with Policygenius in 46 states and Washington, DC, excluding four states for which insufficient data was available.

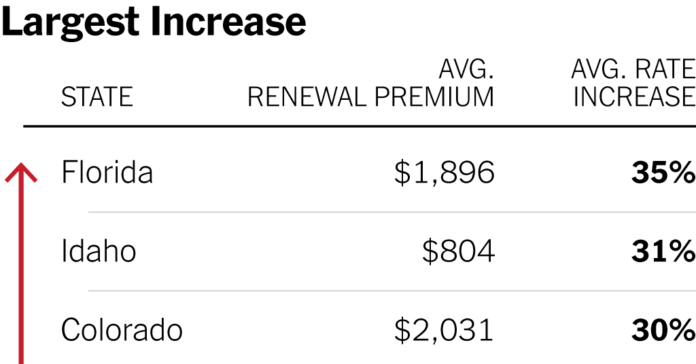

In Florida, rates rose an average of 35 percent, the most of any state. Hurricane Ian, which struck in late September, proved to be the costliest hurricane in the state’s history. In Idaho, where many homes are at risk from wildfires, owners paid an average of 31 percent more. Colorado, South Dakota, Louisiana and Texas also saw significant rate increases as residents faced more losses from natural disasters and fewer insurance options. (East Coast states saw the smallest rate increases at renewal in 2023.)

In fact, some insurers are reducing their losses. Over the summer, Farmers Insurance announced it would not renew about a third of its policies in Florida, while other insurers simply went out of business. In California, State Farm, the state’s largest insurer, stopped issuing new policies this spring. However, as the need for insurance grows, rates will continue to rise.

Inflation and supply chain problems that make repairs more expensive, as well as generally rising real estate prices, are also contributing to higher premiums. This week’s charts show the places where interest rates have risen the most and the least, according to the study.

For weekly email updates on residential real estate news, sign up here.