This section is Presented

This section was created by the editors. The client was not given the opportunity to restrict the content or to check it before publication.

from RBC Mortgages

Breadcrumb Trail Links

Growth in total mortgage debt hit the fastest pace since 2008, the agency says

Publication date:

July 06, 2022 • 19 hours ago • 2 minutes read • 16 comments  A real estate agent’s sign in front of a house that has been sold in Toronto. Photo by REUTERS/Chris Helgren files

A real estate agent’s sign in front of a house that has been sold in Toronto. Photo by REUTERS/Chris Helgren files

content of the article

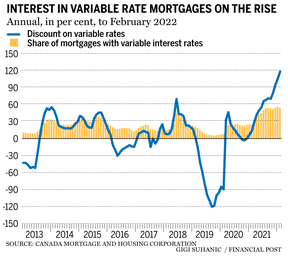

Canadians flocked to adjustable-rate mortgages in the months before the Bank of Canada began rapidly raising interest rates this year, pushing their market share to over 50 percent, a report by the Canada Mortgage and Housing Corporation showed on Wednesday .

content of the article

The CMHC’s semi-annual mortgage industry report found that the trend toward adjustable-rate products extended into the early months of 2022, although it appears to have plateaued in response to recent rate hikes.

According to the report, interest in variables has been fueled by a widening spread between variable and fixed income products.

content of the article

The discount on adjustable rate mortgages reached 118.5 percent in early 2022 as variables accounted for 55 percent of the share of mortgages during that period.

In comparison, variables traded at a premium of 89.5 percent in 2020 and accounted for just 7.4 percent of the new mortgage portion.

The Bank of Canada raised interest rates by 25 basis points in March, followed by two consecutive 50 basis point hikes in April and June to bring the interest rate to 1.5 percent.

content of the article

Mortgage growth continued to accelerate in the third quarter of 2021, bringing Canada’s total residential mortgage debt to $1.77 trillion.

According to the CMHC, this growth in total mortgage debt was the fastest pace seen since 2008.

This acceleration in mortgage borrowing is due to the increase in uninsured mortgages for both home purchases and refinancing in terms of volume and dollar value.

Banks added about $400 billion worth of residential mortgages to their balance sheets thanks to a 43 percent increase in new mortgages for home purchases and a 22 percent increase in refinancing compared to 2020.

Meanwhile, the credit unions had added $54 billion to their portfolios since the beginning of the year. Mortgage Investment Entities (MIEs) also saw an increase in new mortgage activity.

The report also pointed to a slight decrease in mortgage arrears across all lender types in 2021, albeit to varying degrees.

Consumers either continued to make their mortgage payments on time or were able to enter into a payment deferral arrangement for this period.

It said highly liquid real estate markets likely contributed to this downtrend.

• Email: [email protected] | Twitter: denisepglnwn