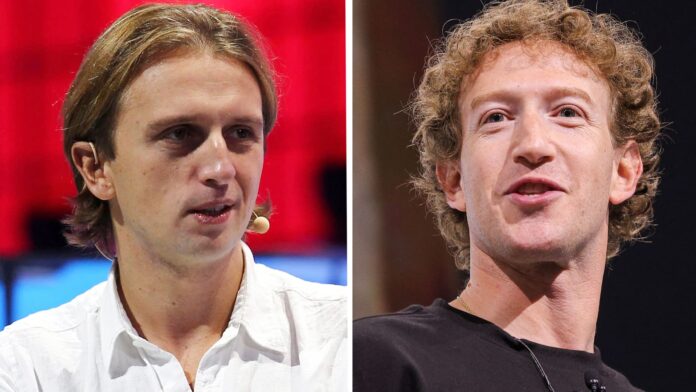

Revolut CEO Nikolay Storonsky (left) and Meta CEO Mark Zuckerberg.

Reuters

British financial technology company Revolut on Thursday criticized Facebook parent company Meta over its approach to fighting fraud, saying the US tech giant should directly compensate people who fall victim to scams through its social media platforms.

A day later Meta announced a partnership with British banks NatWest Revolut said the pact “falls significantly short of what is needed to combat fraud globally.”

In a statement, Woody Malouf, Revolut's head of financial crime, said Meta's plans to combat financial fraud on its platforms amounted to “small steps” when what the industry really needs is big progress.

“These platforms have no responsibility for compensating victims and therefore have no incentive to do anything about it. A data sharing obligation, even if necessary, is simply not good enough,” Malouf added.

A Meta spokesperson told CNBC that its information sharing framework for banks “is designed to enable banks to share information so we can work together to protect people who use our respective services.”

“Fraud is a cross-industry issue that can only be addressed through collaborative work,” the spokesperson said via email. “We encourage banks, including Revolut, to join this effort.”

New payments industry reforms come into force in the United Kingdom on October 7, requiring banks and payment companies to pay victims of so-called Authorized Push Payment (APP) fraud a maximum compensation of £85,000 ($111,000).

Britain's payments regulator had previously recommended a maximum compensation amount of £415,000 for fraud victims, but relented after backlash from banks and payments companies.

Revolut's Malouf said that while his company supports the UK government's anti-fraud measures, Meta and other social media platforms should do their part to financially compensate those who fall victim to fraud as a result of scams on their websites.

The fintech company released a report on Thursday in which it claimed that 62% of user-reported fraud cases on its online banking platform came from Meta, compared to 64% last year.

Facebook was the most common source of all scams reported by Revolut users, accounting for 39% of scams, while WhatsApp was the second highest source of such incidents, accounting for 18%, the bank said in its Consumer Security and Financial Crime Report. .”