Breadcrumb trail links

Still, the Canadian Real Estate Association says it's too early to tell the start of a recovery

Published on January 15, 2024 • Last updated 6 hours ago • 3 minutes reading time

A jump in sales in December – up 8.7 percent from the previous month and 3.7 percent from last December – could provide some optimism for the new year. Photo by Jim Wells/Postmedia

A jump in sales in December – up 8.7 percent from the previous month and 3.7 percent from last December – could provide some optimism for the new year. Photo by Jim Wells/Postmedia

Article content

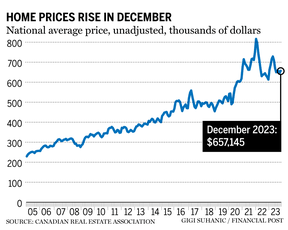

Canadian real estate prices saw a slight increase in 2023 and are expected to rise again in 2024 and 2025. This is evident from figures and forecasts from the Canadian Real Estate Association, which also reported a promising increase in sales at the end of the year.

The organization's MLS Home Price Index (HPI) ended the year 0.7 percent higher than December last year, despite a 0.8 percent month-over-month decline from November. The reference price also rose, increasing by less than one percent over the year to $730,400. Average sales prices, meanwhile, saw stronger gains, rising 5.1 percent to $657,145 since December 2023.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

Article content

A jump in sales in December – up 8.7 percent from the previous month and 3.7 percent from last December – could provide some optimism for the new year.

Shaun Cathcart, senior economist at CREA, said it was too early to say whether this was a sign of what was to come in 2024.

“Was December’s increase in home sales the start of the expected recovery in Canadian real estate markets? Probably not yet,” Cathcart said in the Jan. 15 market report. “It's more likely that just some of the sellers and buyers who held on to unrealistic price expectations last fall ultimately banded together to get deals done before the end of the year. We’re still forecasting a recovery in real estate demand in 2024, but we’ll have to wait a few more months to get a feel for what that ultimately looks like.”

Marc Desormeaux, chief economist at Desjardins, was also careful not to read too much into a single sharp increase in sales.

“Ultimately, today's release does not change our view that the Bank of Canada is done raising rates and will begin cutting rates in the middle of this year,” he wrote. “The Bank of Canada should place more emphasis on the slowdown seen in recent months and look to increasing signs that the Canadian economy is weakening amid sharp increases in borrowing costs.”

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

Karen Yolevski, chief operating officer of Royal LePage Real Estate Service Ltd., said the increased activity will provide a better sense of what has motivated both buyers and sellers.

“As we see people come off the sidelines, we will have a better understanding of whether people are simply waiting to time the market and wait for interest rates to drop to come back to the market,” she said .

In its 2024 housing forecast, CREA said interest rate trends will remain an important factor through 2024 and 2025.

CREA forecasts a 2.3 per cent increase in the national average home price to $694,173 in 2024, with Alberta, Quebec, New Brunswick, Nova Scotia and Newfoundland and Labrador exceeding that level. Meanwhile, markets in British Columbia and Ontario are expected to stabilize and housing prices to remain flat.

Recommended by Editorial

-

Office tenants have the upper hand due to the excess supply of available space

-

Why now could be a good time to get into the real estate market

Approximately 489,661 residential properties are expected to be sold through Canadian MLS Systems in 2024, an increase of 10.4 percent compared to 2023.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

In 2025, nationwide home sales in Canada are expected to rise 7.3 per cent to 525,498 units as interest rates decline toward neutral levels. However, this value is still below the long-term trend. The national average home price is expected to rise four percent to $722,063, driven by rising demand and continued supply constraints. Alberta and the East Coast are expected to outperform other regions in price growth.

• Email: [email protected]

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network