Article content

According to the industry group that represents Canadian real estate agents, nationwide home sales jumped in January compared to a year ago, and both the benchmark and average sales price were also higher. These are hopeful signs that a housing market revival may be underway.

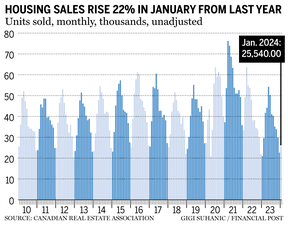

The 22 per cent increase in sales compared to January 2023 marked the sharpest year-over-year increase since May 2021, Canadian Real Estate Association data released on February 14 showed.

Article content

Benchmark home prices rose 0.6 percent year over year to $717,800, but fell 1.2 percent month over month. However, the national average home price increased 7.6 percent since January 2023 to $659,395.

“Sales have increased, market conditions have tightened significantly and there is anecdotal evidence of renewed competition among buyers; However, prices are still trending downward in areas where sales have increased the most over the past two months,” said Shaun Cathcart, senior economist at CREA. “Taken together, these trends suggest a market that is beginning to turn around but is still overcoming the weakness of the last two years.”

Markets where prices have fallen are primarily in Ontario, particularly the greater Golden Horseshoe area, with some in British Columbia. Prices in other parts of Canada remain mostly stable and are still rising in some regions, such as Alberta and Newfoundland and Labrador.

Although the number of transactions increased significantly compared to January 2023, the increase was partly due to the low comparable basis and overall activity is still below average.

Article content

On a seasonally adjusted basis, sales rose 3.7 percent compared to December 2023, after rising 7.9 percent month-on-month. While current activity is comparable to the stronger spring and summer months of 2023, it still lags the 10-year average by about nine percent as we enter 2024.

The number of newly listed homes rose 1.5 percent in January compared to the previous month, but is still near its lowest level since last June.

For Desjardins economist Marc Desormeaux, the economic backdrop means it is “too early to assume that a return to exuberant market conditions across the country is imminent.”

“Although January results were better than expected, we still do not believe Canada's labor market has felt the full impact of the interest rate hikes already implemented,” he said in a note to clients. “These could weaken housing demand in the coming months.”

Recommended by Editorial

-

The condominium market is facing a significant slowdown

-

The average house price in Toronto will rise again in 2024

-

Paying cash down on your mortgage can save you money

Desormeaux expects the Bank of Canada to begin cutting rates in the second quarter of the year, providing some relief to mortgage holders.

• Email: [email protected]

Would you like to learn more about the mortgage market? Read Robert McLister's new weekly column in the Financial Post for the latest trends and details on funding opportunities you won't want to miss

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Share this article on your social network