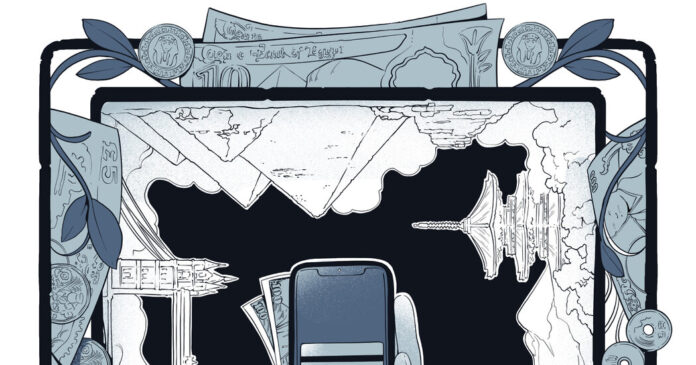

Using foreign money wisely requires understanding the current exchange rate to the US dollar and implementing the following strategies to avoid overcharges.

Go for a card that doesn’t charge transaction fees

The most important rule when managing purchases abroad is to ensure that you do not use a credit card that incurs transaction fees abroad.

“Everything you buy will be 3 percent more expensive if you have a card that doesn’t waive exchange rate fees,” said Nick Ewen, content director at Points Guy, a travel website focused on maximizing credit card benefits.

You don’t need an expensive card with an annual fee of $500 or more to waive foreign transaction fees. Capital One offers cards with no annual fees or foreign transaction fees. Personal finance website NerdWallet maintains a list of credit cards that don’t charge a fee for foreign transactions.

Credit cards are often safer than cash because fraudulent allegations can be disputed. (However, given the high interest rates, you should only use credit cards if you regularly pay off the balance in full.)

If you plan to pay primarily with credit, bring a second card as a backup in case the first card is lost, stolen, or declined.

Ask to be billed in local currency

If you are given the option to bill in US dollars or local currency, always choose the local option.

“People feel like they’re playing with Monopoly money, so they say yes to the U.S. price because they know what it is, but you should leave the conversion to the credit card company,” said Sally French, travel expert at NerdWallet.

Merchants that offer payments in local currency or US dollars engage in “dynamic currency conversion,” or set their own exchange rate, which is typically worse than the prevailing bank rate. Mr. Ewen of the Points Guy has seen a 3 to 10 percent markup for paying in dollars.

“The reason you get a favorable exchange rate with a credit card is because the card issuer is much larger and can handle a large volume of transactions,” said Greg McBride, chief financial analyst at Bankrate, a personal finance website.

Do not exchange money at the airport

Although you may need cash to pay for a taxi or tip a bellman when you arrive abroad, don’t get it at the airport.

“In general, the airport is the worst place to exchange money,” Ms. French said.

She recommends ordering a small amount of foreign currency from your bank before your flight. This method may not provide the best exchange rate, but is usually better than the airport exchange, Ms. French said.

Other experts recommend waiting to bring foreign cash until you arrive and using a local ATM, where you’ll most likely get a better exchange rate.

As with credit cards, if you have the option, always choose to make a withdrawal in the local currency. Some ATMs perform dynamic currency conversion and issue the local currency but debit your account with a US dollar amount. Don’t fall for it.

In addition, larger hotels often spend small amounts of money on behalf of their guests.

Be aware of ATM fees

According to NerdWallet, you can expect to pay $2 to $6 to use an ATM that’s outside your bank’s network, plus an additional foreign transaction fee, usually 1 to 3 percent. To avoid excessive fees, limit the number of times you use an ATM by withdrawing larger amounts.

Check with your bank to see if they have a reciprocal relationship with a foreign bank that allows you to use their ATMs without incurring out-of-network fees. For example, Bank of America has partnerships with a number of banks in Canada, Europe and the Caribbean, but generally charges 3 percent of the amount withdrawn as a foreign exchange fee.

Depending on the type of account, Citibank waives out-of-network ATM fees up to a certain number of monthly transactions. Charles Schwab Bank offers a worldwide checking account with unlimited ATM fee reimbursement. Capital One offers a checking account with fee-free access to more than 70,000 ATMs worldwide.

Use mobile payment for local transport

Depending on your destination, check whether local transportation systems accept mobile payments such as Apple Pay or Google Pay, which allow users to store a credit card in a mobile app for contactless transactions. Transport for London, for example, allows mobile payments and caps all fees once you reach the price of a day pass.

The systems in Stockholm and Toronto also enable mobile transactions.

Don’t go home with coins

In countries such as Canada and Australia, local currency typically consists of high-denomination coins valued at $1 or more. When you pay with cash, it’s easy to find your pockets stuffed with coins. Try spending or donating abroad as it is more difficult to exchange coins for US dollars once you are back in the US. For example, Bank of America does not accept coins for exchange.