Investors got respite from a painful sell-off as the Dow Jones Industrial Average and S&P 500 rallied to end their best weeks since November 2020.

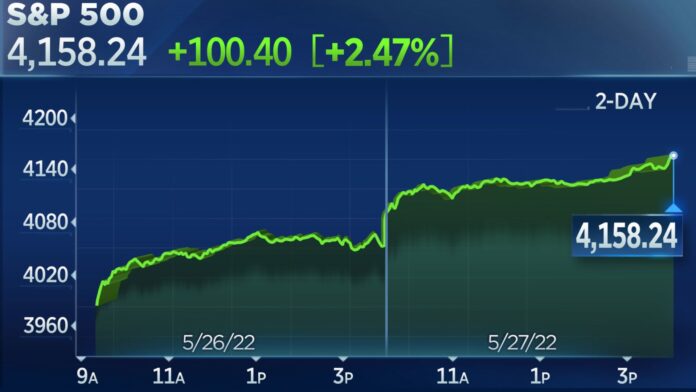

The Dow rose 575.77 points, or nearly 1.8%, to 33,212.96. The S&P 500 was up about 2.5% to 4,158.24. The tech-heavy Nasdaq Composite was the outperformer, helped by strong gains from software companies and a decline in the 10-year Treasury yield. It ended the day up 3.3% to 12,131.13.

All three major moving averages ended the week higher. The Dow ended the week up 6.2%, posting its longest losing streak, eight weeks, since 1923. The S&P 500 is up 6.5% and the Nasdaq is up 6.8% for the week. Both indices ended their seven-week dry spell. A large chunk of weekly gains came on Thursday and Friday, when all three averages rallied as strong retail earnings and a softening inflation report lifted sentiment.

“We’re taking a breather here and making some adjustments to the market to allow for this,” Tom Martin, senior portfolio manager at Globalt Investments, told CNBC. “We’ve come a long way down pretty quickly and if we can stabilize here, the declines that we’ve seen might be all that’s needed or something like that.”

A report showing inflation slowing somewhat gave shares a boost on Friday. The core personal consumption expenditure index rose 4.9% in April, compared with 5.2% in the previous month. This particular report is closely watched by the Federal Reserve as it sets policy.

Investors continued to analyze retail earnings on Friday. Ulta Beauty’s shares rose nearly 12.5% after the company reported better-than-expected quarterly results, while Gap gained 4.3% despite cutting its earnings guidance.

“The consumer seems to have a ‘barbell’ approach to spending: low-end necessities and high-end experiences/luxury items do well, while general merchandise spending is delayed, ie getting another year out of that wear and tear on patio furniture is fine ‘ Wells Fargo’s Christopher Harvey said on Friday.

“This week, various retailers have started to balance the macro narrative, with the consumer’s decline now appearing to be grossly exaggerated,” he added.

Tech stocks were among the top gainers on Wednesday. Software company Autodesk rose 10.3% after reporting strong earnings for its latest quarter. Dell Technologies rose 12.8% in earnings and chipmaker Marvell rose 6.7%. Zscaler and Datadog were also higher on Friday, up about 12.6% and 9.4%, respectively.

The moves came as investors assessed the sustainability of this week’s rally and whether it is a bounce or the bottom of this year’s long sell-off.

Stock picks and investment trends from CNBC Pro:

Still, averages are a long way from their highs, with the Nasdaq Composite still solid in bear market territory and the S&P 500 briefly falling more than 20% from its record last week.

The Nasdaq is now about 25.2% off its record, while the S&P 500 and Dow are down 13.7% and 10.1%, respectively.

Jeff Kilburg, Sanctuary Wealth’s chief investment officer, said he sees the Treasury market as a “beacon” for the stock market. The 10-year government bond yield has fallen below 2.75% from a peak of over 3% this year.

“I’m not calling it a bear rally, just a repositioning. A lot of people got too pessimistic,” Kilburg said. “Coming back to interest rates. When you saw that Treasuries had that jump above 3%, it wasn’t sustainable. When it fell below 2.75%, allowing stocks to heal, that was the short-term all-clear to get back into stocks.”