Breadcrumb Trail Links

A look at the data shows that sales over the past year have held up against secular trends that make for a likely recovery this year

A “For Sale” sign hangs outside a home in Toronto. Photo by Carlos Osorio/Reuters files

A “For Sale” sign hangs outside a home in Toronto. Photo by Carlos Osorio/Reuters files

content of the article

Most experts believe the long-term outlook for housing is positive, but there is a lack of consensus on the short-term future of housing markets, with some believing prices will fall further this year while others expect a turnaround once interest rates start to pick up stabilize .

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

Given these conflicting views, one wonders how reviewing the same statistics and trends can lead to such different forecasts. When analyzing the housing market, however, it all comes down to motivation.

Financial post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

content of the article

For example, let’s say the data is being reviewed by those experts who told you so, who have been predicting an impending market crash for decades. Their market pronouncements will tend to sound more bleak, even though their crash forecasts are wrong year after year. On the other hand, those whose well-being may be tied to a quick market rally will see a silver lining in every dark cloud. For them, the glass is never half empty.

Our review of December 2022 data from the Canadian Real Estate Association (CREA) reveals trends that contrast with the often-repeated gloomy headlines.

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

For starters, average home prices have increased by 2.4 percent in 2022 compared to 2021. Average prices rose by double digits in Quebec, New Brunswick, Nova Scotia and Prince Edward Island, and they also rose 6.8 and 7.5 percent in British Columbia and 7.5 percent, respectively.

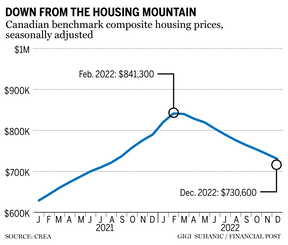

What drove average house prices higher was the boom in the first quarter of 2022. However, prices have fallen significantly since then. Monthly comparisons show significant price declines, with even more pronounced declines observed compared to the February and March 2022 peaks.

CREA also benchmarks a quality- and size-adjusted home price index (HPI), a favorite indicator of home price dynamics because it compares apples to apples. This seasonally adjusted reference price was 1.6 percent lower in December than in November, 9.1 percent lower than six months earlier and 7.5 percent lower than in December 2021.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

But a longer-term comparison shows that in December, the benchmark price is up 33 percent over three years and 29.7 percent over five years. Five-year gains were higher for less populous cities in Ontario and the Maritimes. Calgary is a big city that has marched in a similar direction, with the benchmark price rising.

Consequently, how to measure price momentum is important. Yes, house prices have been falling since the first quarter of 2022, but the average price in 2022 was higher than the year before, so the drop wasn’t catastrophic.

In the more populous provinces, however, sales volumes in 2022 fell significantly compared to the previous year. Overall, Canada saw about 168,000 fewer sales in 2022, down 25 percent from 2021. Ontario and British Columbia, the two most expensive provinces for housing, saw more significant sales declines, while Alberta again stood out. with a drop in sales of a little less than two percent.

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

One might be tempted to conclude from the dismal sales numbers that housing demand has taken a severe hit from rising borrowing costs, and indeed mortgage rates are partly to blame for the decline.

An important but often ignored factor is that more than 200,000 additional sales unexpectedly took place in 2020 and 2021. Some of these transactions would have happened in 2022 or 2023 but were brought forward to take advantage of extremely low mortgage rates.

Leaving aside the frenzy fueled by cheap credit, sales volume in 2022 was in line with the long-term pre-pandemic trend. Therefore, we expect more home transactions in 2023 than in the previous year.

-

Peter Hall: The hard stop to housing construction means problems for the economy

-

The pace of housing starts slowed in December and ended flat compared to 2021

-

Canada’s home prices will fall nearly 6% this year, CREA forecasts

advertising 6

This ad has not yet loaded, but your article continues below.

content of the article

How will the markets develop in 2023? Much depends on the direction in which interest rates develop. News of layoffs has already surfaced in the United States, with Microsoft Corp. laid off 10,000 of its global workforce. Bank executives in Canada warn tens of thousands of borrowers are at risk because of rising mortgage costs.

If the cost of borrowing continues to rise, home sales and prices will likely struggle and see even more declines, but by lesser magnitudes than before. However, if mortgage rates stabilize by mid-year, house prices are not unlikely to reverse.

Canadian housing markets have responded sensibly to the broader shifts in the macro economy. The declines in sales and prices were the logical and measured response to a series of shocks to the economic system. Barring an unexpectedly large future shock, 2023 is likely to see a rebound in Canada’s housing market.

Murtaza Haider is Professor of Real Estate Management and Director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Share this article on your social network

similar posts

Remarks

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.