Breadcrumb trail links

The decline in sales was partly due to Good Friday falling in March this year

Published on April 3, 2024 • Last updated 17 hours ago • 3 minutes reading time

You can save this article by registering for free here. Or log in if you have an account.

A house for sale in Toronto. The average benchmark price rose in March, TRREB said. Photo by Peter J. Thompson/National Post

A house for sale in Toronto. The average benchmark price rose in March, TRREB said. Photo by Peter J. Thompson/National Post

Article content

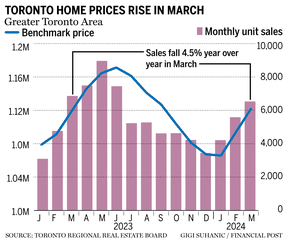

Toronto home prices rose in March but sales fell from a year ago, a mixed result that the region's real estate board attributed in part to an additional public holiday this month.

Benchmark home prices rose 2.5 per cent month-over-month and 0.3 per cent year-over-year to $1,121,615, according to monthly figures from the Toronto Regional Real Estate Board (TRREB). However, the number of homes changing hands fell 4.5 percent year-on-year to 6,560 units. New registrations rose by 15 percent in the same period.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

REGISTER/LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Log in or create an account

or

Article content

Article content

In a press release, TRREB said the decline in sales was partly due to Good Friday falling in March rather than April this year.

TRREB President Jennifer Pearce said market conditions were improving despite the slowdown and lower borrowing costs expected later in the year would accelerate that trend.

“We have seen a gradual improvement in market conditions over the last quarter,” Pearce said in the report. “More buyers have adapted to the higher interest rate environment. At the same time, homeowners may be anticipating an improvement in market conditions in the spring, which explains the significant increase in new listings so far this year.”

Pearce said if borrowing costs fall in the near term, sales will likely increase, new listings will be absorbed and tighter market conditions will drive up sales prices.

TRREB chief market analyst Jason Mercer also said prices are expected to rise in the coming months if borrowing costs fall as expected.

“Price growth is expected to accelerate in the spring and even more strongly in the second half of the year as sales growth catches up with supply growth and seller market conditions begin to improve in many neighborhoods. Lower borrowing costs in the coming months will help boost demand for condominiums,” Mercer said in the report.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

While TRREB maintained an optimistic outlook for the spring market, economists and industry observers are more cautious.

Desjardins economist Marc Desormeaux said market conditions and economic performance don't look particularly robust this spring.

“We would not necessarily interpret TRREB's March results as an indication of great strength in the market or economy. You know, sales were down year-over-year. “The average price has only increased by about one percent year-on-year, which is below the inflation rate,” said Desormeaux.

In a strategy report released Wednesday, National Bank of Canada investment adviser Darren King said he believes the national economy will continue to underperform even after the first rate cut.

“We will be keeping a close eye on housing market developments over the next few months, particularly as we expect the Bank of Canada to cut its federal funds rate in July as the national economy is expected to remain sluggish,” King said.

Recommended by Editorial

-

Surge in luxury home sales signals a stronger spring market

-

Currently the lowest nationwide mortgage rates in Canada

-

The reverse mortgage card puts a plastic twist on unlocking home equity

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

The Toronto market saw condo sales decline the most, falling 12.8 per cent year-over-year and 6.2 per cent from February to March. Condo listings also rose for the ninth time in 10 months, resulting in a record number of listings on a seasonally adjusted basis, according to an analysis by National Bank Financial.

Year-on-year, sales of single-family homes fell by three percent, while sales of semi-detached homes increased by 4.3 percent and those of terraced homes increased by 1.1 percent.

• Email: shcampbell@postmedia.com

Would you like to learn more about the mortgage market? Read Robert McLister's new weekly column in the Financial Post for the latest trends and details on financing opportunities you won't want to miss.

Article content

Share this article on your social network